Losing your job can be one of the most stressful and daunting experiences imaginable, and when it occurs, it has the potential to derail even your best-laid plans completely. But it doesn’t have to leave you hopeless and destitute. With the unsettled financial climate that we’ve now entered, there’s no better time to take advantage of the safety net afforded to you by Federal Decree-Law No. 13 and the Involuntary Loss of Employment Scheme (ILOE) of 2022. Indeed, starting 1 January 2023, it will become mandatory for all employees in the UAE.

The ILOE scheme seeks to provide improved quality of life for those who have had their employment contract terminated until such a time that they find new opportunities. This is, however, subject to a few provisos and is limited to a period no longer than three consecutive months per claim.

Eligibility Criteria

A whole raft of benefits come with safeguarding yourself in the event of unemployment, and selecting the right plan is vital in creating a sense of stability and financial freedom. But there are eligibility considerations that need to be met before you can proceed, namely:

- A minimum of 12 months’ subscription to the scheme, with no interruption to that subscription for three consecutive months.

- All insurance premiums are paid timeously and in full.

- Provision of proof that the employment contract was terminated and that no resignation has occurred.

- You may not be dismissed for disciplinary reasons as per the Labor Relations Law and Human Resources Law of the federal government.

- You must submit your claim within 30 days of your employment contract’s termination.

- There should be no existing complaint pertaining to absence from work.

- You will not be entitled to compensation if any fraud or deceit is involved in your claim.

- Loss of your employment should not come from non-peaceful labor strikes or stoppages, irrespective of whether they cause harm.

- You must be legally stationed in the United Arab Emirates.

- There are a host of technical criteria, which you can find at the bottom of this page.

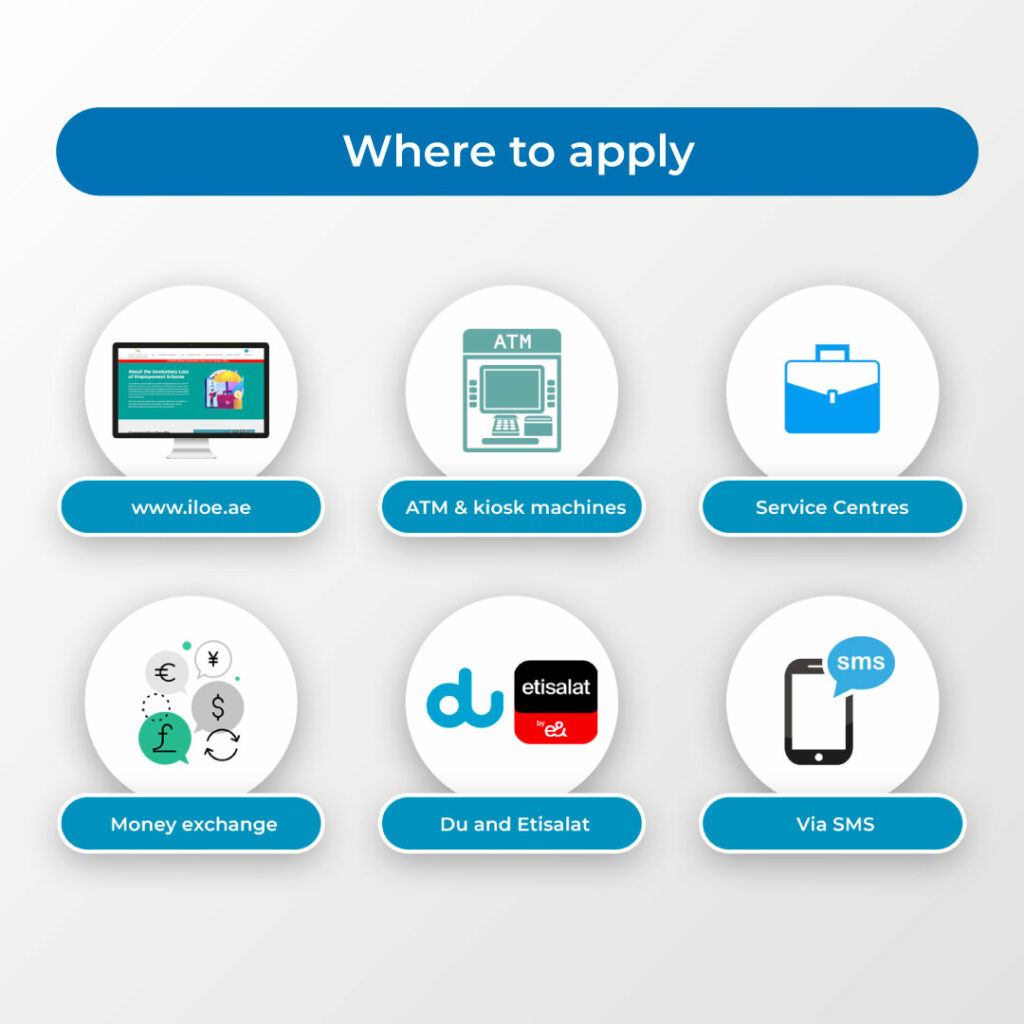

Subscription Channels

There are lots of ways for you to begin your ILOE subscription and the process is simple and easy to complete. Ensure your compliance with any of the following channels:

- Insurance Pool’s website which you can find at www.iloe.ae or on the smart app.

- Banks ATMs and selected kiosk machines

- Selected business service centers

- Money exchange companies

- Du and Etisalat

- Via SMS

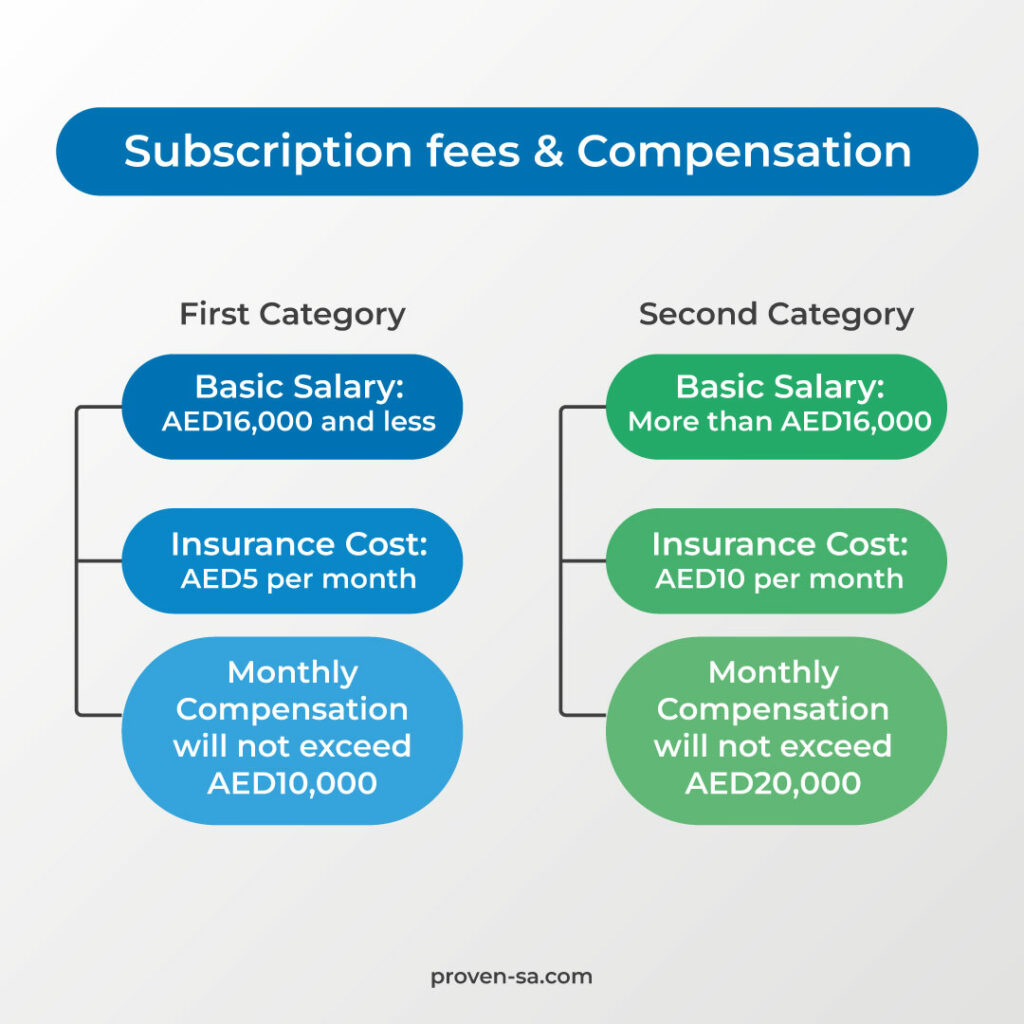

Compensation Benefits

A whole raft of benefits come with safeguarding yourself in the event of unemployment, and selecting the right plan is vital in creating a sense of stability and financial freedom. Choose between monthly, quarterly, half yearly or annual payments. Let’s take a look at some of the benefits available to you.

Insurance Policy Providers

The Dubai Insurance Company represents the insurance pool of 9 national insurance providers.

- Dubai Insurance Company

- Abu Dhabi National Insurance Company

- Al Ain Ahlia Insurance Company

- Emirates Insurance Company

- National General Insurance Company

- Orient Insurance

- Abu Dhabi National Takaful Company

- Oman Insurance Company

- Orient UNB Takaful Company

Start Preparing For Your ILOE Subscription on 1 January 2023

As we approach the end of the year, it’s hugely important that you get your affairs in order before the scheme comes into effect on 1 January 2023. Being prepared for sudden changes in course isn’t an admission of future failures. It simply means that you’ve considered all the outcomes and acted accordingly.