For a good reason, FinTech is an industry that has attracted a large amount of interest and an incredible amount of investment. It is no mystery, then, that the Saudi Arabian market has since become ripe for the FinTech revolution.

The Kingdom is the ideal market to expand or establish your FinTech business. The country is consciously making strides to ensure that it becomes an easier market in which to do business. Typically, this has seen a flurry of new rules and regulations, including those pertaining to the FinTech ecosystem, which allows for an effective path to foreign investment.

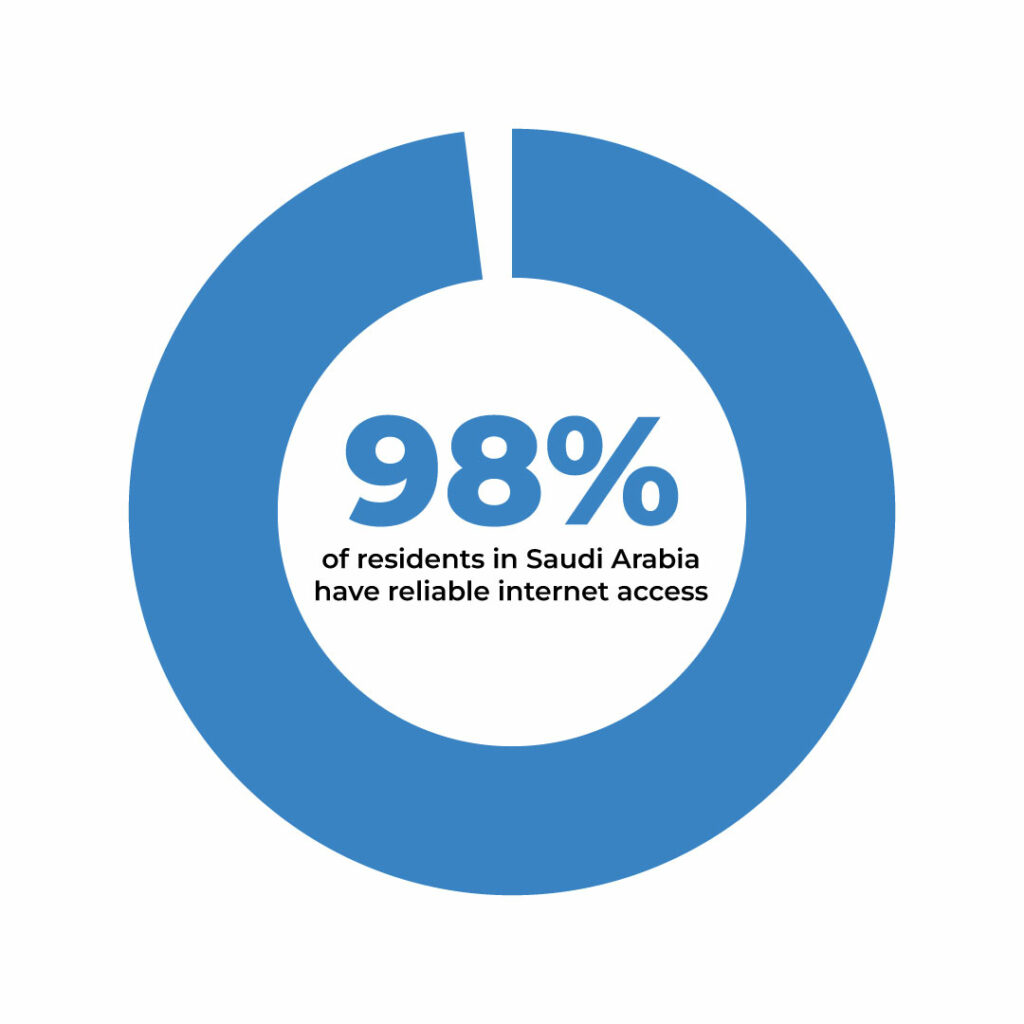

As one of the largest economies in the Middle East and with some of the highest access to the Internet per capita in the region (98% of residents in Saudi Arabia have reliable internet access), Saudi Arabia has all the makings of an economy that is poised to position itself as one of the most prominent financial hubs in the world.

The Saudi Arabian Monetary Authority (SAMA) has already unveiled its open banking policy framework, which seeks to ensure that banking information is safely shared through the GCC nations, allowing for fast and cheap financial transactions to be concluded.

This new policy goes hand-in-hand with the new Payment Services Law, which seeks to create a more clearly defined path for entrants into the payment services sector while also creating certainty about the commitment of the Saudi authorities to growing the sector.

Off the back of these new regulations, there has been an explosion in growth in the sector which has prompted both SAMA and the Capital Markets Authority (CMA) to introduce new regulations that deal with the provision of crowdfunding and lending services, as well as the necessary data aggregation sector, which deal with the new demands of credit-scoring and KYC in real-time.

A massive benefit to this style of regulation is that the financial barrier to entry is greatly reduced, as big and established players will no longer have the monopoly on vital consumer information, thus allowing for data-driven products and services to be developed while being guided by real-world, real-time information.

In a region that is still undeveloped in this space, and with a potential customer base in excess of 150 million people, the foundation is being laid for rapid growth in the FinTech sector, with the regulators and central banks working towards ensuring that there is a regulatory framework that supports sustainable growth.

The incorporation and post-incorporation process

The first step to starting your business is to incorporate it. The Kingdom provides for incorporating several vehicles, including branch offices, an LLC, or a joint stock company. This stage typically entails obtaining an investment license and registering the company with the Ministry of Commerce (MoC) and the Ministry of Investment of Saudi Arabia( MISA). Once this stage has been completed, it is where some of the more nuanced aspects, referred to as secondary registration, of doing business in Saudi Arabia come to the fore.

The secondary registration requirements can be broken down into the following steps:

- 1. Registration of the signatory with the Chamber of Commerce (CoC)

- 2. Opening of a company file with the Ministry of Human Resources and Social Development (MHRSD)

- 3. Opening of the company file with the General Organisation of Social Insurance (GOSI)

- 4. Registering with General Authority for Zakat, Tax, and Custom Authority (ZATCA)

- 5. Health Insurance, National Address and P.O. Box registration

- 6. Application for Ministerial and Defence Licences

- 7. Muqeem portal registration

- 8. Qiwa portal registration

- 9. Mudad portal registration.

In addition to these steps, FinTech companies have a few more hoops to jump through before beginning operations.

Additional steps for FinTech registration

SAMA, the regulator of FinTech activities, requires the following documents to be submitted by a potential Finance Support Company:

- 1. The SAMA application form

- 2. The MOI and AOA of the company

- 3. A list of all members/founders/shareholders, indicating the respective shares held by each. Should SAMA be engaged during the pre-incorporation process, the shareholders shall provide an irrevocable bank guarantee, issued by a local bank, for the required minimum capital requirements, with the guarantee being released upon:

- 3.1 The capital being paid in full, in cash

- 3.2. Should the application be withdrawn

- 3.3. Should the licence application be rejected by SAMA.

- 4. Any pre-incorporation contracts, in draft form or completed, with any third parties

In respect of the management requirements for the FinTech company, the following points need to be considered when planning for the structure of the management team:

- 1. The individuals must meet the professional requirements set by SAMA

- 2. They must be permanent residents of Saudi

- 3. Be suitably qualified and experienced

- 4. Be fit and proper individuals, in as far as they have not violated any of the local regulations or provisions of the Capital Control Laws, the Banking Control Law and other similar provisions

- 5. Not have been convicted of an offense that involves dishonesty, fraud or other similar offenses

Upon receiving approval from SAMA, the company will have six months to commence operations, failing which the provisional approval will be revoked and the reapplication undertaken from the first step.

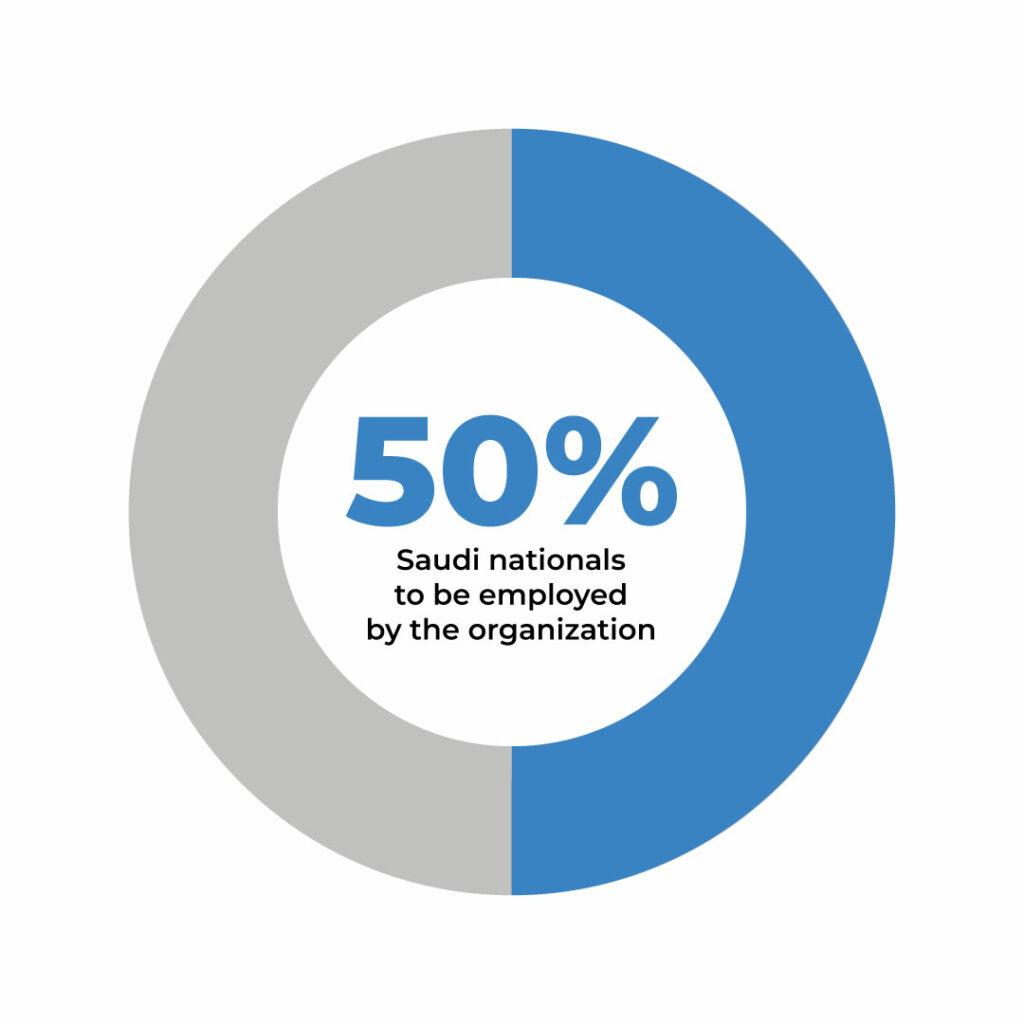

Licenses are only valid for three years, after which a renewal application will need to be submitted at least three months before the expiration of the period. Once you have been licensed and are compliant and ready to start operations, the next requirement to satisfy would be that of Saudization – the requirement for Saudi nationals to be employed by the organization. Within the FinTech sector, this is set at 50% of the total company workforce.

There is no doubt that Saudi Arabia is primed for growth within the region. However, doing business in the Kingdom must be approached from the perspective of adhering to the existing regulatory and legal framework. To avoid committing costly mistakes, it makes sense to measure twice and cut once when it comes to your expansion strategy in the region. With over a decade of experience operating within the Kingdom’s business and economic landscape, PROVEN is a local partner that can guide you through each step of your expansion into the region.

In addition to the incorporation of your company, PROVEN can also provide professional recruitment services, employer of record services, and assistance with ongoing regulatory requirements. We offer unparalleled service to our clients within the region, having saved clients millions of dollars in potential wasted costs by giving them accurate advice from the onset of their projects.

Anita Chalke

Sr. Manager : Regional Corporate Services

anita.c@proven-sa.com